The TerraUSD incident sent ripples through the blockchain and DeFi communities, signaling what was the definitive start of a crypto bear market. This incident was a huge financial disaster for many individuals, but it also raised many interesting questions:

- Do algorithmic stablecoins have a future?

- Will TerraUSD manage to revive itself?

- Is heavy crypto-regulation just around the corner?

The Tesseract Academy is committed to helping decision makers and the public better understand deep tech such as AI, data science and blockchain. For this reason, we conducted research on the topic of algorithmic stablecoins and TerraUSD, by asking 30 subject matter experts to offer us their opinion.

Preliminaries: What are stablecoins?

Our CEO, Dr Stylianos Kampakis writes:

“There are three main types of stablecoins:

- fiat-collateralized,

- crypto-collateralized

- non-collateralized (or algorithmic)

The most famous examples of fiat-collateralised stablecoins are USDC and USDT. The USDC token issued by Circle is backed by $1 worth of fiat currency for every USDC issued. The most biggest stablecoin (by market cap) is USDT , which is backed by a variety of assets. USDT, however, has been very controversial, as its liquidity has many times been disputed. Finally, another example of a stable coin is the BUSD, which has been created by Binance (which is the largest crypto exchange).

Crypto-collateralised use crypto instead of fiat assts as collateral. These projects usually follow under the umbrella of Decentralised Finance (DeFi). A great example is DAI, which has been created by MakerDAO. To create DAI, you need to provide some other crypto as collateral. This provides the necessary liquidity to the system. There is also one more token called MKR. The MKR token provides backstop liquidity in case the system accumulates bad debt, and holding MKR also entitles you to vote on how the Maker protocol is run.

Finally, algorithmic stablecoins are aiming to keep a peg using only algorithms. Algorithmic cryptocurrencies are still backed by crypto, like crypto-collateralised stablecoins. The difference is that in algorithmic stablecoins, this process takes place automatically. The best example of one such stablecoin is Frax.”

Algorithmic stablecoins report: The Questions

We asked 5 questions, the last two ones being a open question, allowing the participants to express their thoughts freely.

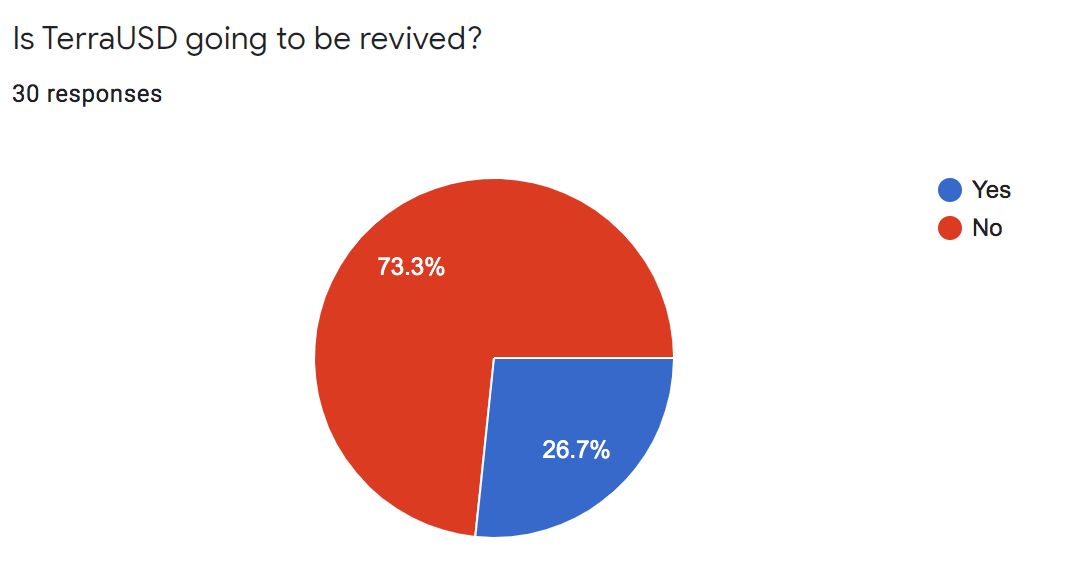

- Is TerraUSD going to be revived?

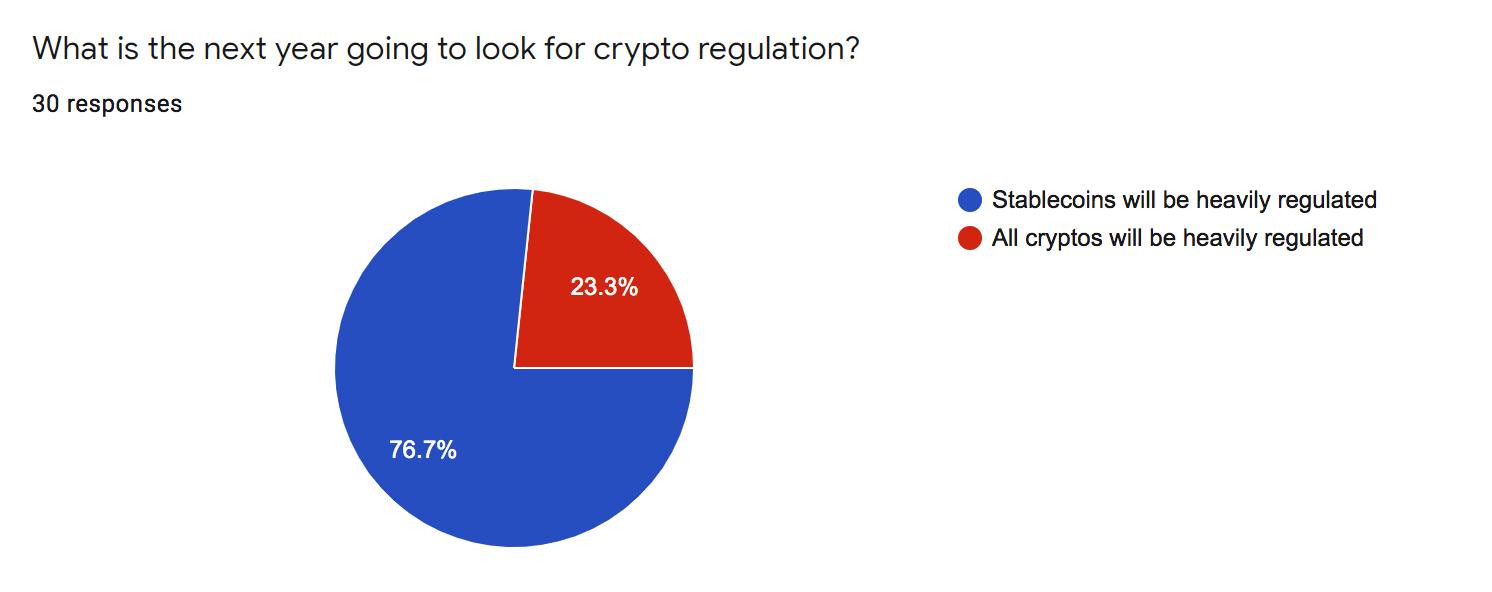

- What is the next year going to look for crypto regulation?

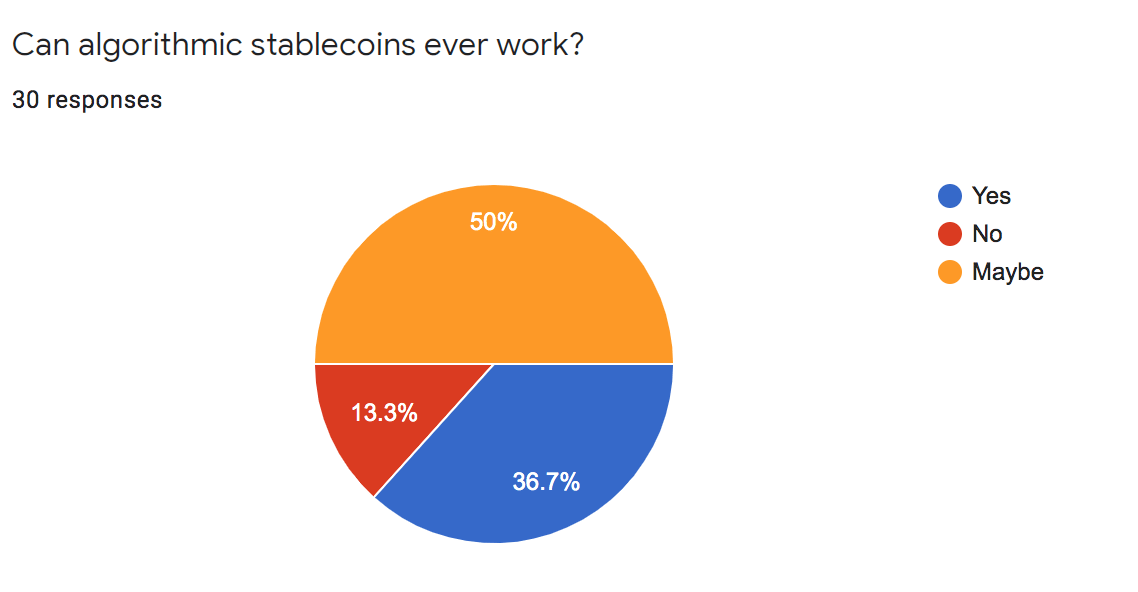

- Can algorithmic stablecoins ever work?

- What is coming in the next few months in the crypto space? Severe crash? Prolonged bear market? Stabilisation? Or something else?

- Any other comments on the current situation with Terra/Luna?

We had 30 responses in total.

Algorithmic stablecoins report: The answers

Only around 1 in 4 believe that TerraUSD will be revived. Whilst this research was being conducted, Terra announced an actual revival plan, but it looks like most of the participants are not convinced. One of the participants comments:

The Terraform Labs just announced a new “revival plan”, with a proposal to fork Terra into a new chain dropping $Terra. It is funny to note that the Terraform Labs’ reaction to the $Terra de-peg aimed to save $Terra over Luna by minting a large quantity of Luna (to absorb the $Terra oversupply), then accelerating the Luna lethal fall. Now the Terraform Labs’ revival plan looked “beyond the mere $Terra”, indicating $Terra should not be the priority for the community. There is currently a lot of scepticism about the Terraform Labs’ capabilities (and Do Kwon’s) to run the revival project in light of a contentious management of the crisis.

The majority of the participants believe that crypto regulation is coming. Again, this comes as no surprise, since this topic is being discussed more and more. It’s possible that regulators will take the TerraUSD incident as an excuse to impose heavy regulation, not only on stablecoins, but also on DeFi and crypto transactions in general.

A very interesting response pattern was observed for the question below. More than 1 in 3 believe that algorithmic stablecoins can actually work. Also, 50% of the subject matter experts are undecided on the topic, but have not given up completely on the potential of an algorithmic stablecoin working. Our position that partially-collateralised algorithmic stablecoins like Frax and BankX have a better future, given that they combine the advantages of collateralisation with an algorithmic peg.

The 4th question was “What is coming in the next few months in the crypto space? Severe crash? Prolonged bear market? Stabilisation? Or something else?“. That question was a free text question, as we allowed the participants to freely express their thoughts. Around 85% of the respondents expect a prolonged bear market, with 15% expecting a stabilisation. This comes as no surprise, given the current state of the crypto market.

The 5th question was “Any other comments on the current situation with Terra/Luna?”

Some comments that stand out

The reason I answered “Maybe” to the 5th question is because I actually believed UST could work when I first invested in LUNA in the beginning of 2021. Terra in the beginning was supposed to be a project that would get people to use crypto in everyday life. Particularly using UST as form of payments for real-world goods & services. There was supposed to be alternative sources of demand for LUNA & UST outside of the arbitrage and Anchor yields. Somewhere along the way though Do Kwon’s ego got the best of him and grew the network too fast through Anchor. I got out of Terra a month before the crash. At the time over 70% of the Terra’s $20 billion TVL was in Anchor, that is when I knew Terra was a ticking time bomb. I don’t know if UST would’ve worked if Do Kwon focused more on adoption rather than growth, but Terra would still be around today if he had. With a stronger ecosystem of projects, there would have been more demand for LUNA & UST to support the peg. Maybe that would have delayed the inevitable but for an algorithmic stablecoin to work it needs to offer something other than arbitrage and yield.

Olaoluwa Samuel-Biyi says that “[…] if any social good financial system like an algorithmic stablecoin can be exploited, it should. Resilience to exploitation must be the defining factor for any trustworthy money system.”

Also, Viraj Patel, a tokenomics advisor living in New York, says:

The Terra/Luna situation highlights the need for a proper stable coin. Currently there is a lack of stable coins that can be trusted. The crypto markets would greatly benefit from a fully audited over collateralized stable coin.

Summary

Algorithmic stablecoins are a fascinating idea. The TerraUSD incident brought scepticism to many in the crypto community, as to whether algorithmic stablecoins are really viable. While it looks we are in a bear market, many subject matter experts still believe that the game is not over for this fascinating crypto asset. If anything, the TerraUSD crash will make the community more aware of potential pitfalls, and the crypto-ecosystem will emerge more resilient from this downturn.

If you are interested in tokenomics or blockchain, make sure to check out our services, or simply get in touch.