Claims in insurance and machine learning

Claims are an important part of the insurance business. An insurer has the obligation to reimburse (or offer some other kind of ) any valid claim.

Therefore, it is imperative that insurers have a good understanding of the volume of claims they should expect to see in the near future. This is especially true for B2C insurance providers who might be facing a larger and more frequent number of claims compared to B2B providers.

The Tesseract Academy recently successfully completed a project with a world-leading electronics insurer provider. In this article, we will go through some of the things we did for them and how we went about them.

Forecasting claims: Problem specification

Our client was a leading electronics insurer. The business insures mobile devices against incidents such as accidental damage and theft.

This means that the business needs to keep devices in stock in case they are needed. But this is where the problem arises. If the company buys more devices than needed, it might end up spending more money than it should. If it doesn’t have enough devices in stock, then it might not be able to service the claim on time.

Therefore, the goal of our projects was to build a predictive modelling pipeline which could predict what would be the expected number of claims for each mobile device.

Forecasting claims: From statistical modelling to machine learning

We were faced with the challenge of forecasting over 1000 devices. The devices were released in different years, were in different parts of their lifecycle, and different specifications (such as memory, colour, size, etc.). This makes for a very complicated problem space.

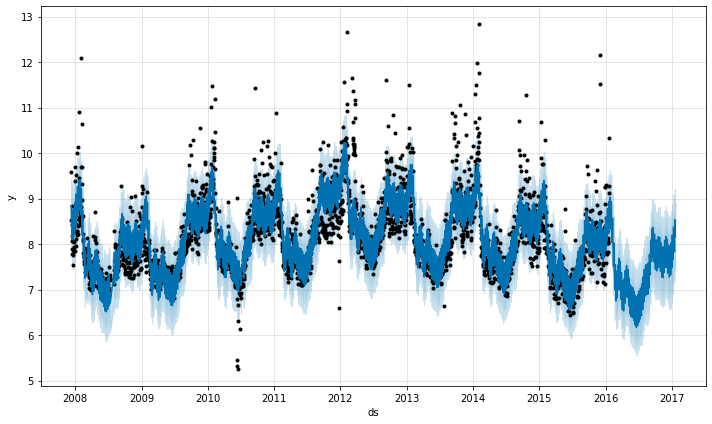

In order to do that, we used a variety of techniques, such as:

- Exponential smoothing

- Kalman filters

- Prophet

- ARIMA

- Tesseract’s custom AI forecaster

The combination of techniques ensures that we can cover any type of pattern, from simple patterns, to seasonal patterns, to trends unfolding overtime. Forecasting is a dark art, and we are masters of it.

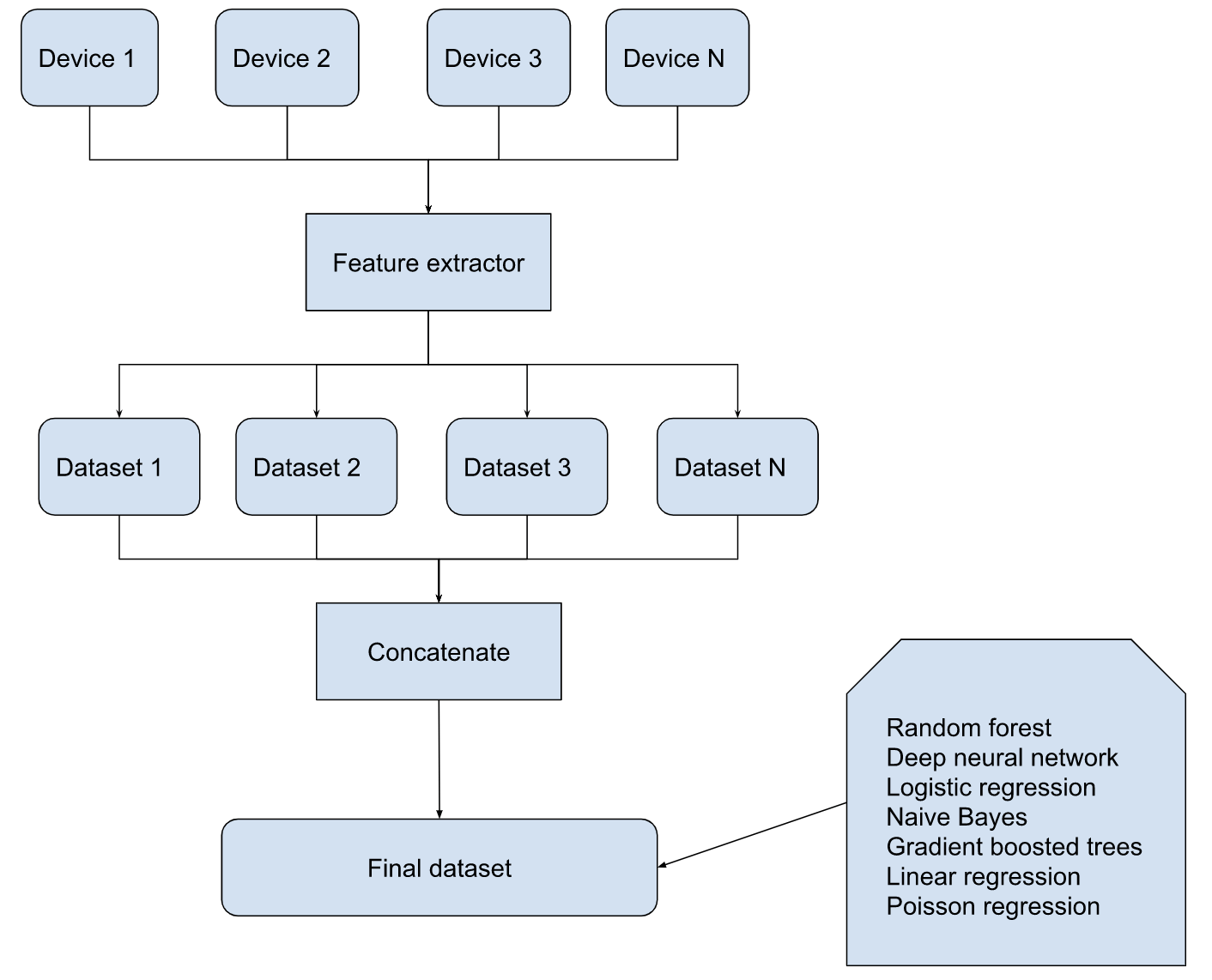

Tesseract’s custom AI forecaster

One of the things we had the opportunity to use in this project to try out Tesseract Academy’s custom AI forecasting tool. This tool combines many different feature extraction approaches and machine learning algorithms, in order to create a unique forecasting method with excellent accuracy and generalisability.

One of the advantages of our method is that it allowed us to group all devices together. This means that the algorithm can learn all the different pattern variations that exist, and then detect whether a device is following one of those patterns. This makes forecasting much way more accurate.

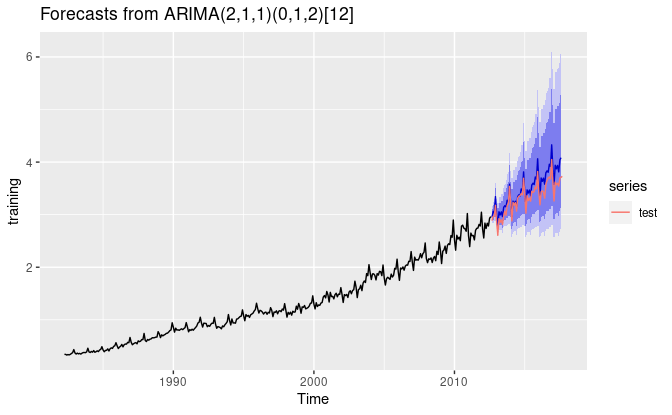

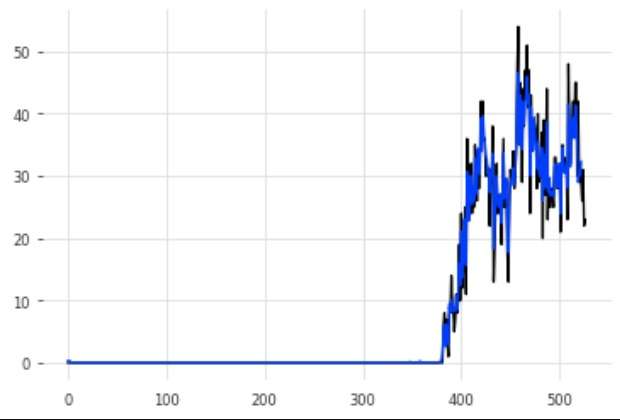

One of the challenges that we faced is what is called “concept drift”. This is when the underlying pattern that is being studied changes. An example of such a pattern is shown in the image below. Our AI forecaster is able to accurately deal with situations like these, because it has seen similar patterns occurring in other devices, and has learned how to detect them.

Forecasting claims: Results and conclusion

When our project finished, we benchmarked our results against the predictions of human experts. We end up performing up to 50% better in many cases. This means that over the course of a year, a company can save close to £1million, by optimising its stock levels and supply chain operations, through the use of AI-based forecasts.

This is the real power of data science. When used appropriately, it can optimise operations, increase margins, and improve efficiency across the board. The initial cost of setting up the project cost a fraction of the total money saved. And the best part for our client is that the savings will keep accumulating over the years.

If you are intrigued by this case study and want to see how we could do the same for your company, then make sure to get in touch. We’ll be happy to help you.